Curated blog with news, events, listings, jobs and exciting stories about web design & web development.

How To Safely Pass EU VAT Tax Audits With EDD Stores

Are you running an online store powered by Easy Digital Downloads? If you have to charge VAT to European customers you might want to have a look at EU VAT for EDD. The supporting evidence for each sale is being safely stored in your WordPress database. But have you ever wondered what happens if your business is ever subject to an EU VAT audit? Have no fear!

Easily Add European VAT Support To EDD »

EU VAT Tax Audit?

European VAT law requires you to keep two pieces of evidence to prove the location of your customers. Easy Digital Downloads takes care of this by storing the customer’s country and IP address.

You must also keep the tax invoice of each customer for up to ten years. The EU VAT plugin deals with this by converting the payment details pages into complete tax invoices. Alternatively, you can use the PDF invoice plugin.

If you are ever audited, you need to know how to access the evidence! Fortunately, there are several ways to do this:

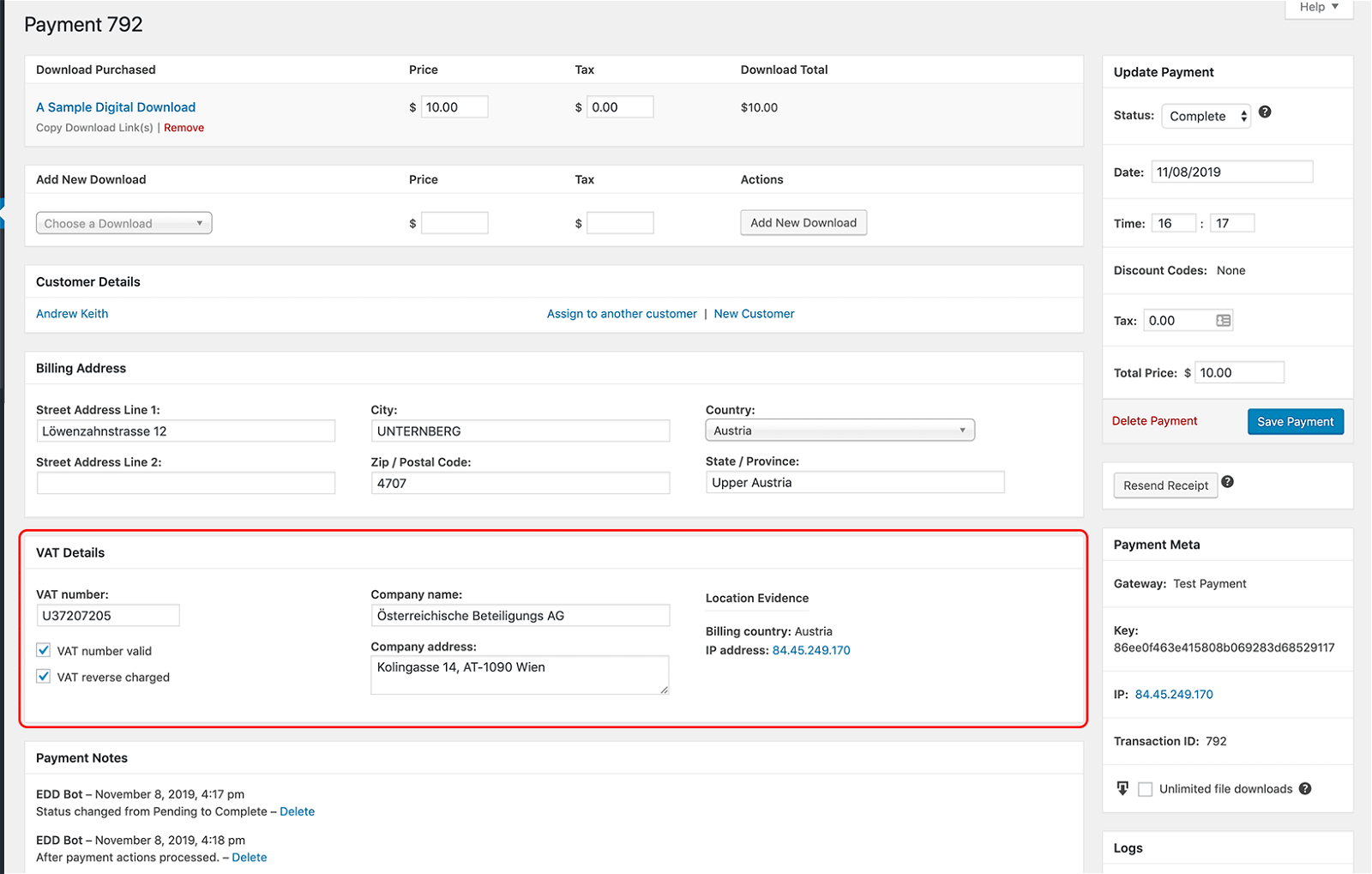

- EDD Payment Screen

You can easily check the evidence for individual payments by going to Downloads > Add New, clicking on a payment, and checking the VAT Details section. - Information Export

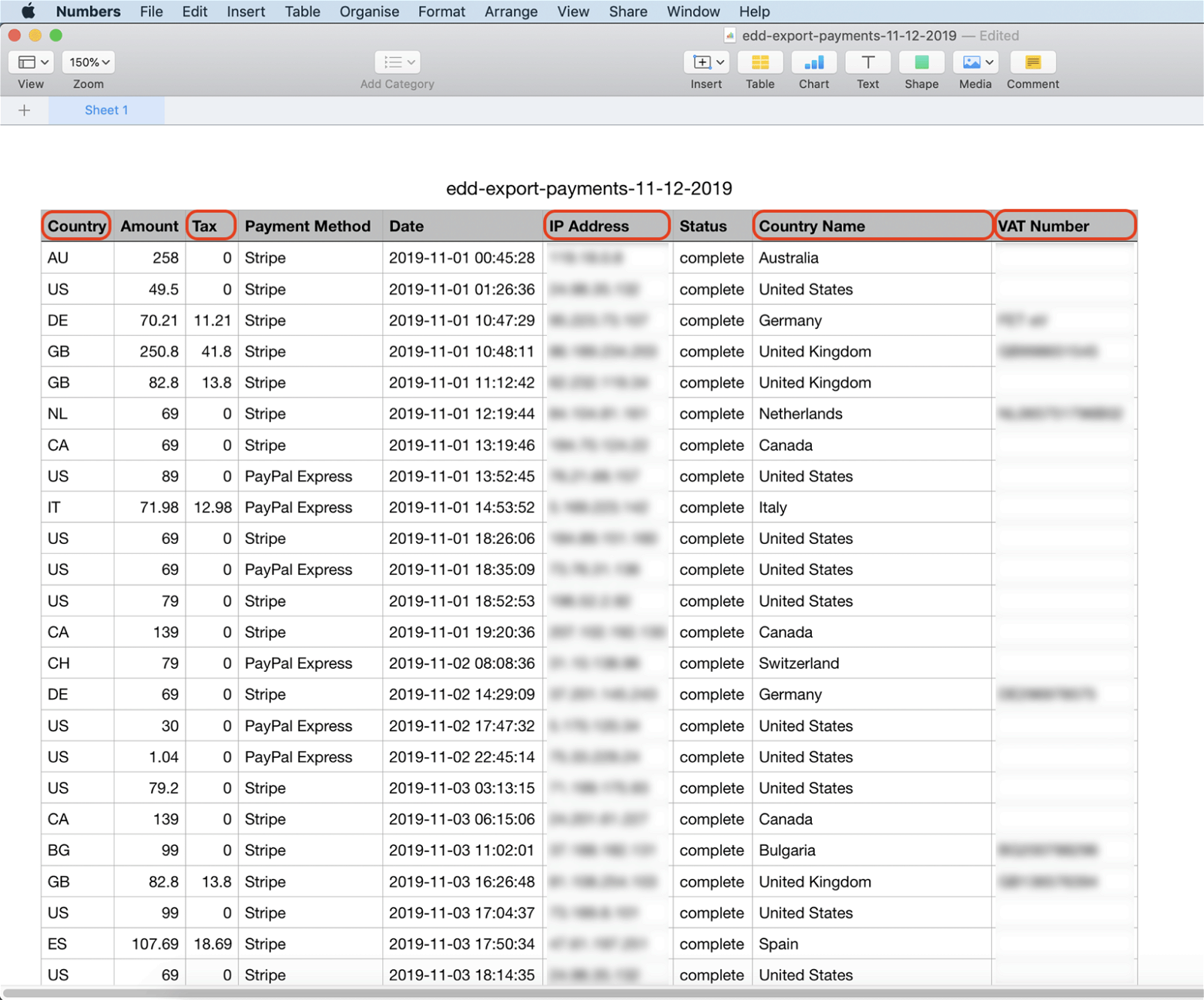

The EDD payment export under Downloads > Reports > Export contains all the information you need for tax purposes. You can open this using any spreadsheet software and format it in any way you need.

Get the EU VAT plugin today to ensure that your EDD store meets the European VAT rules for digital products.

The Fair Freelancer Marketplace

Freelancers, would you like to win 1 of 5 free business profiles for life? Sign up to enter the competition.

Ahoi.pro, the new fair freelance marketplace is about to launch! Sign up to be among the first to be notified!

FTC Disclosure: We may receive a payment in connection with purchases of products or services featured in this post.