Curated blog with news, events, listings, jobs and exciting stories about web design & web development.

TaxJar: Free Sales & Transactions Checker For Economic Nexus

TaxJar just released a free tool that allows you to find out where you are required to collect sales tax after the Supreme Court rules. Meet the new Sales & Transactions Checker.

Find Out Where You May Have Economic Nexus »

In their landmark decision in the South Dakota v. Wayfair case, the Supreme Court of the United States (SCOTUS) just radically changed the sales tax landscape for online sellers. But don’t panic! This blog post will take a look at what has changed and how online sellers can determine next steps to remain sales tax compliant.

What did South Dakota v. Wayfair change about sales tax?

Before SCOTUS handed down their recent decision, states could only require online sellers with a physical presence in the state to collect that state’s sales tax. So, in the past, if you had a location, employee, or inventory stored in a fulfillment center (such as through Amazon FBA) you could be required to collect sales tax. Known as the Quill v. North Dakota precedent, this law of the land prevented states from imposing sales tax collection obligations on businesses with no physical presence in the state.

However, the Supreme Court has now stripped away that protection from sellers. This means that states have another tool in their arsenal when it comes to compelling online sellers to collect sales tax: economic nexus.

What is economic nexus? Economic nexus occurs when a business meets a certain threshold of economic activity in a state. This threshold varies by state, but is commonly $100,000 in sales in a state or 200 transactions. When a business meets this threshold, states can now require online sellers to collect the state’s sales tax from in-state buyers.

Example: Let’s look at the state of South Dakota. Before the Wayfair case was decided, a seller was only required to collect South Dakota sales tax if she had a physical presence such as a location, employee or inventory in the state. If a seller had no physical presence, then she had no obligation to collect sales tax when shipping her products into South Dakota.

After Wayfair, due to South Dakota’s economic nexus law, a seller is considered to have economic nexus if she makes $100,000 in revenue in the state in a calendar year or more than 200 transactions in the state in a calendar year. Now, even if the seller doesn’t have a physical presence in the state, she is required to collect South Dakota sales tax if her sales meet that economic threshold.

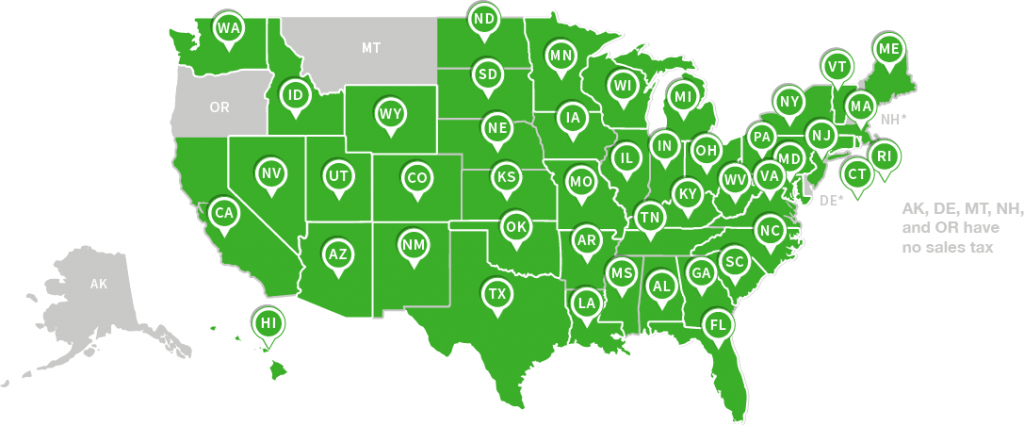

Which states currently have economic nexus laws?

Twenty-two states currently have economic nexus laws on the books (though some go into effect in the future), with more states (like Texas, Wisconsin and Minnesota) declaring that they will soon pass economic nexus laws or regulations based on the Wayfair decision.

Sales & Transactions Checker

I’m an online seller. What should I do now? Your first step is to get educated. Find out if any state’s current or future economic nexus laws apply to you. You can do this for free with TaxJar’s Sales & Transactions Checker.

With their Sales & Transactions Checker, just connect to the online shopping carts and marketplaces on which you sell and then run the checker. They will show you states where you have met the economic nexus thresholds and then provide guidance on next steps.

Find Out Where You May Have Economic Nexus »

I meet economic nexus thresholds in a state. What do I do now?

First, double check when the law goes into effect. Some economic nexus laws were set to go into place either the same day that the Wayfair decision was handed down, or July 1, 2018. But other state laws don’t go into effect until October 1, 2018, January 1, 2019 or another date. Once you are ready to register and the law is in effect, register for a sales tax permit in that

state.

I have questions. Who can help me?

We’ve put together a vetted list of sales tax experts who are happy to help you determine if you meet economic nexus thresholds. They can also help you if you have other questions, such as what to do if you realize you should have been collecting sales tax but have not.

Is every state going to pass an identical $100,000/200 transaction law like South Dakota passed?

The Supreme Court did not rule that economic nexus needs to be set at $100,000/200 transactions, only that the South Dakota economic nexus law is legal. With that said, $100,000/200 transactions is the path of least resistance for any state looking to implement their own economic nexus law. Only time will tell how many states follow South Dakota’s lead and

how many choose to set different economic nexus thresholds. As new laws are passed, they’ll update their economic nexus state list.

I’m an international seller. Does this ruling impact me?

In short, any seller who has some form of sales tax nexus in the US is required to collect sales tax from US buyers. This includes international sellers who have physical presence in the US, or international sellers who do not have physical presence in the US but who exceed a state’s economic nexus thresholds. The Supreme Court did not impose any limitations on which companies states can require to collect sales tax.

Hopefully this post has helped demystify the Supreme Court’s sales tax ruling in Wayfair v. South Dakota.

This post was brought to you by TaxJar, the leading sales tax compliance solution for online sellers. For a limited time, the TaxJar Sales and Transactions Checker is totally free for all online sellers. Run your sales through the TaxJar Sales and Transactions Checker and find instant peace of mind! Please note: This post is for informational purposes only.

Biff Codes - The Job Board for WordPress Devs

Biff.codes is on a mission to revolutionize job boards. Post and find WordPress developer jobs for free.

FTC Disclosure: We may receive a payment in connection with purchases of products or services featured in this post.

Add your first comment to this post