Curated blog with news, events, listings, jobs and exciting stories about web design & web development.

TaxJar AutoFile: Save Hours of Precious Time with Sales Tax Filing on Autopilot

Next Monday on May 1st, sales tax filing is due in tech-savvy California. If you are having nightmares about complicated sales tax returns, you might want to have a close look at TaxJar AutoFile. No more frustration and headaches, but happy times ahead!

Enroll in AutoFile now for just $19.95 »

TaxJar AutoFile

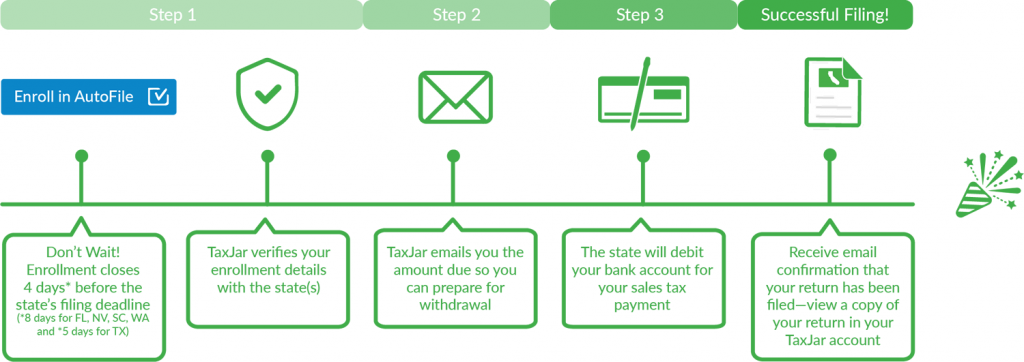

AutoFile is an automatic electronic filing service for US state sales tax that makes it simple for you. Simply enroll in AutoFile up to 4 days before the state’s deadline and skip filing all together (8 days in FL, NV, SC & WA; 5 days in TX). Let TaxJar handle submitting your return to the state. On-time, every time!

Benefits & Pricing

- Automatic electronic filing service for state sales tax in any US state

- Preparation & submission of returns to the state including payments

- Use of Information provided by connected ecommerce platforms & marketplaces, e.g. WooCommerce, Magento, Amazon, Shopify & BigCommerce

- TaxJar does not keep discounts for on-time filing offered by some states

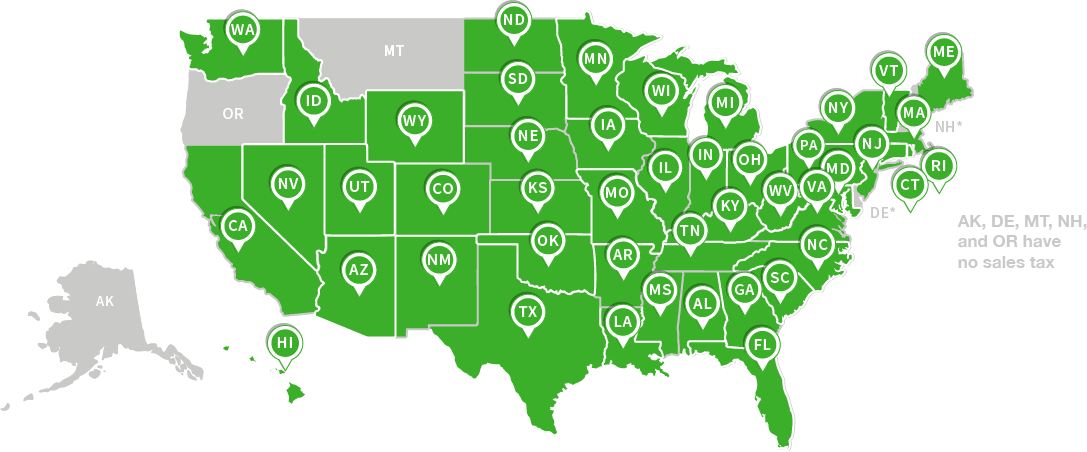

50-State AutoFile

For quite a while, 50-state AutoFile has been their most requested feature. As of July 2017, TaxJar is now auto-filing sales tax in all 50 US states. That’s good news, eh?

AutoFile can be added for just $19.95 per filing to your normal TaxJar subscription. However, the first filing will be refunded upon request.

Just a Few Simple Steps

- Enroll in AutoFile

- TaxJar verifies enrollment details with your state

- You’ll receive an email with the amount due

- The state will debit your bank account for your sales tax payment

- You’ll get a PDF email confirmation and can view your filing history via your account

Not sure if TaxJar is for you? Start your 30-day free trial now. Please note that the AutoFile service requires a paid plan.

Enroll in AutoFile now for just $19.95 »

Side Note: Amazon.com Now Collecting Sales Tax

Amazon’s recent announcement to collect sales tax in all US states led to quite a confusion among Amazon sellers. Find out why Amazon’s decision doesn’t affect third party sellers on TaxJar’s blog post.

The Fair Freelancer Marketplace

Freelancers, would you like to win 1 of 5 free business profiles for life? Sign up to enter the competition.

Ahoi.pro, the new fair freelance marketplace is about to launch! Sign up to be among the first to be notified!

FTC Disclosure: We may receive a payment in connection with purchases of products or services featured in this post.