Curated blog with news, events, listings, jobs and exciting stories about web design & web development.

SureCart Introduces Tax Overrides

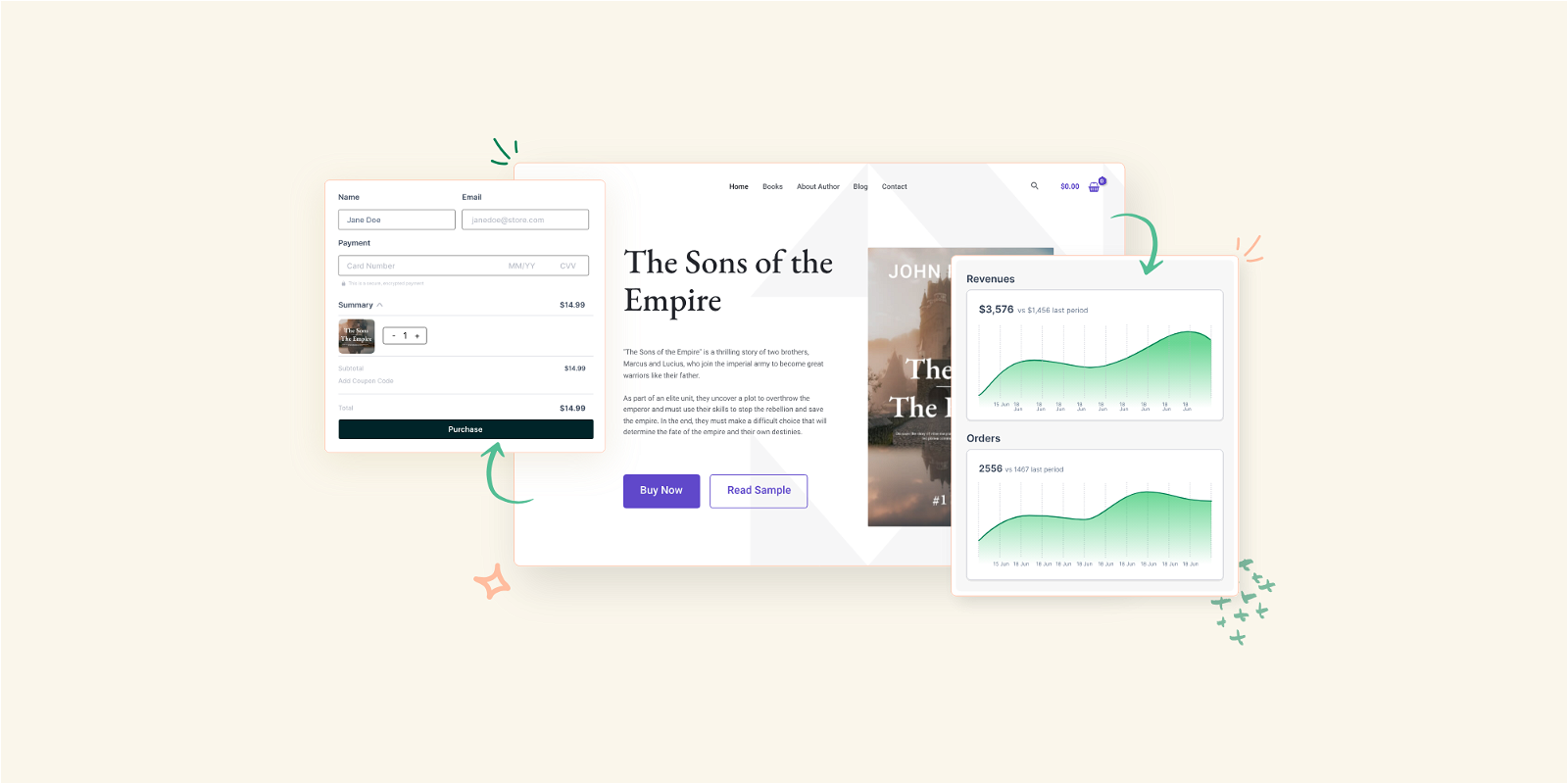

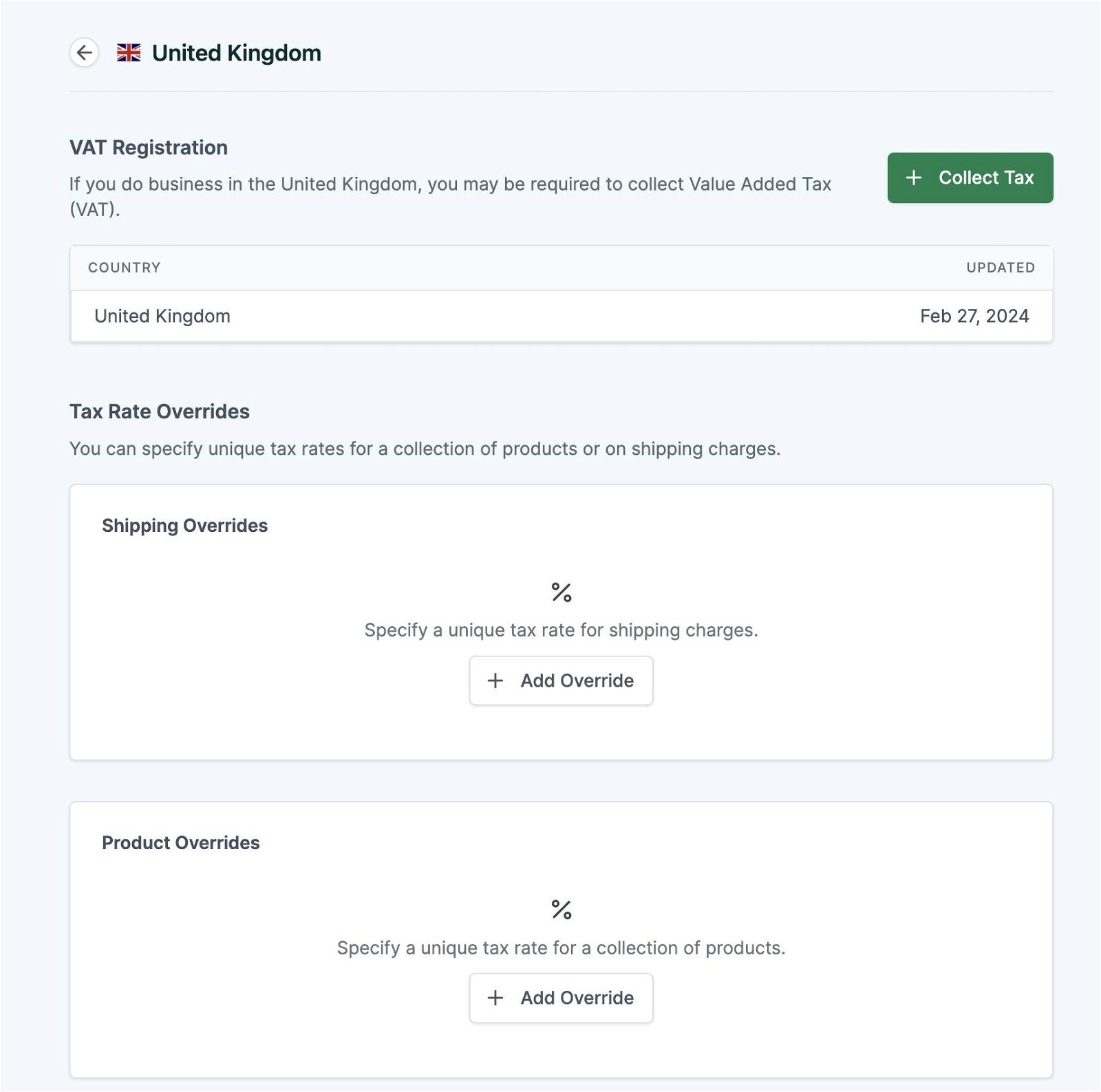

Adam from SureCart has announced tax overrides in version 2.20 of their e-commerce platform for WordPress, giving merchants granular control over tax rates for specific items and product categories.

Tax Overrides

When developing the e-commerce platform, one of the SureCart team’s goals was to make tax collection easy and automated. All without the need for an expensive third-party service for real-time tax calculations.

Tax overrides allow you to charge a unique tax rate for specific products, product categories or shipping. For example, if you sell food and drink in Germany, the tax rate is 7% instead of 19% in most cases.

Setup takes just 3 simple steps:

- Create a new product collection to group the products you want to add a tax override to.

- Add the products to the collection.

- Visit the tax settings and create a tax override for the product collection.

Update: Shortly afterwards, SureCart released an update to better break down the individual tax rates for each product. Now the shopper will see the tax rate applied to each item, for example 19% VAT for a membership fee and 7% for a book. If you are currently using a custom invoice template, you will need to revert to the default if you want the new breakdown.

The good news: Despite the significant cost of the Tax Overrides feature for SureCart, it is available to all merchants.

The Fair Freelancer Marketplace

Freelancers, would you like to win 1 of 5 free business profiles for life? Sign up to enter the competition.

Ahoi.pro, the new fair freelance marketplace is about to launch! Sign up to be among the first to be notified!

FTC Disclosure: We may receive a payment in connection with purchases of products or services featured in this post.